This article aims to give you, S R Auditor’s esteemed client, a step-to step guide on how to file your return of income on the TRA eFiling system.

TRA’s new eFiling system can be accessed by visiting https://ots.tra.go.tz:8090/ (Read more about it here)

Filing of Returns (Return of Income) | www.sra.co.tz

Step 1: Filing of returns is done after log in by an individual e-filer or appointed Declarant of the entity. In order to file returns, click on “Returns” on the log in home screen where you will select “Unfiled Returns” for individual e-filer and “Entity Unfiled Returns” for a declarant of the entity. A list of unfiled returns will pop up as depicted on the screen below:

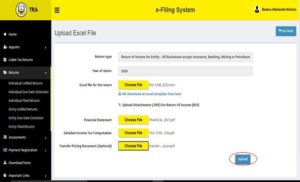

Step 2: Select an appropriate return and click “e-file” in order to start filing of such a return. For returns of income, a screen like the following will appear indicating return type, year of return, month of return and an option to choose a file or download a return in the form of an excel template. Similarly, it will prompt mandatory uploading of Financial Statement and Detailed Income Tax Computation and optional uploading of Transfer Pricing Documentation (which is mandatory to eligible e-filers)

Step 3: An e-filer/Declarant will be required to upload a return that has been filled with all required information by clicking “Choose File”. Similarly, you will be required to upload Financial Statements, Tax Computation and Transfer Pricing Contemporaneous Documentation (for eligible taxpayers only). Upon selection of the file, its name will appear as indicated on the screen below

Step 4: Click “Upload” in order to upload the return in excel format and accompanied attachments for further processing. You will receive the message prompting you to review the uploaded return before further processing as indicated below

Step 5: Click “Preview” in order to confirm the information contained in your uploaded return. You will be directed to the screen as depicted below:

Step 6: If there is any need to cancel the process after review of the return you can do the same by clicking “Cancel” and you can upload another file. However, if the information is correct click “Submit” to send your return for processing/assessment. Upon clicking “Submit” the return will be submitted to the S R Auditors for certification and the following message shall pop up to confirm submission; (If you do not know how to appoint S R Auditors as your audit firm, contact us for assistance via 022-2124067 or i[a]sra.co.tz (replace [a] with @))

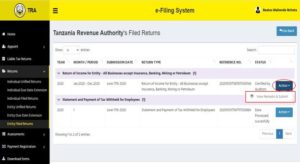

Step 7: After certification by S R Auditors, an e-filer will receive the certified returns and be required to review and submit it to TRA. The Declarant will be able to view certified returns from a list of filed returns. Certified return of income will have a status reading “Certified by Auditors” as indicated on the screen below:

Step 8: To view Auditor’s remarks, click “Action” to obtain an option to view remarks and submit to TRA as depicted on the screen below:

Step 9: You can review Returns together with all other attachments. If there is any need to terminate the process, click “Cancel” as it appears on the screen below but if the returns and attachments are correct, click “Submit” as it appears on the screen below to submit the return to TRA for further processing

Step 10: After you clicking “Submit” you will be prompted to confirm your option as indicated on the screen below where you will be required to click “Yes Submit it” to confirm

Step 11: You will then receive a confirmation that your returns have been sent to TRA by receiving the message depicted on the following screen (However, it should be noted that, the message does not provide a confirmation of successful filing of return)

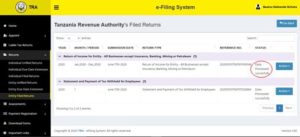

Step 12: If the return has been filed and processed successfully, it will appear on the list of submitted returns with a status reading “Data Processed Successfully” as indicated on the following screen

Step 13: Following successful filing of return of income, you can view or save a copy of TRA’s Acknowledgement of Return, Submitted Return, Assessment issued and all the Attachments by clicking “Action” as indicated on the screen below

DISCLAIMER

As always, anything on this site should not be relied upon in place of appropriate professional advice. Laws may change from time to time.

For professional tax advice, Connect with us.